Car title loans provide a simple borrowing solution for debt consolidation or emergencies in Fort Worth. Lenders assess your vehicle's value, age, and condition to offer a percentage as a loan. Minimum monthly payments are calculated based on the loan balance, interest rate, and repayment period, enabling borrowers to manage debt effectively without penalties. Understanding how to manually calculate these payments, prioritizing extra payments, and maintaining your car's value can help minimize interest and shorten loan terms.

Are you considering a car title loan but want to understand the numbers? This guide breaks down how to calculate your car title loan minimum payments manually. We’ll walk you through the structure of these loans and provide step-by-step instructions for a clear, precise calculation. Additionally, learn tips for effective repayment and potential savings, empowering you with knowledge in the world of car title loan minimum payments.

- Understanding Car Title Loan Structures

- Manual Calculation Steps for Minimum Payments

- Tips for Effective Repayment and Savings

Understanding Car Title Loan Structures

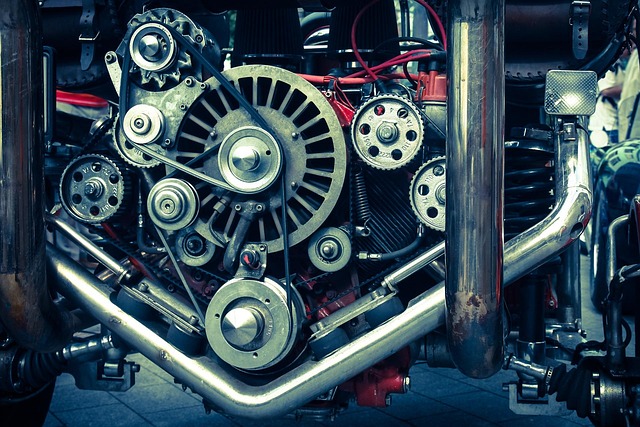

Car title loans are a unique form of secured lending where an individual’s vehicle serves as collateral for the loan. Unlike traditional loans that often require complex calculations and various fees, car title loans have straightforward structures. The primary factor determining the loan terms is the value of the vehicle and the borrower’s ability to repay. Lenders in cities like Fort Worth Loans assess the vehicle’s condition, age, and market value to offer a loan amount, typically a small percentage of its total worth.

This type of loan is particularly attractive for those seeking debt consolidation or emergency funding. The process involves manually calculating the minimum monthly payments based on the loan balance, interest rate, and repayment period. By understanding these components, borrowers can make informed decisions, ensuring they meet their obligations without facing hefty penalties or extending their debt burden unnecessarily.

Manual Calculation Steps for Minimum Payments

To calculate car title loan minimum payments manually, start by gathering essential details like the vehicle’s valuation, loan amount, and interest rate. The vehicle valuation is a critical factor as it determines the maximum loan eligibility. Next, identify the term of the loan, usually expressed in months. This step is crucial for understanding your monthly financial obligation.

Divide the annual interest rate by 12 to get the monthly interest rate. Then, add this rate to 1 to account for compounding interest. Multiply the loan amount by this compound interest factor raised to the power of the loan term (in months). Finally, divide the result by the number of payments in a year to arrive at your minimum monthly payment. This process ensures you understand and can manage your car title loan minimum payments effectively.

Tips for Effective Repayment and Savings

To effectively repay a car title loan and maximize savings, it’s crucial to understand your repayment options. One popular approach is to make extra payments beyond the minimum due each month. This strategy not only reduces the interest accrued but also shortens the overall loan term. Prioritize paying down the principal balance first to minimize interest charges over time.

Additionally, keeping your vehicle in good condition can significantly impact your savings. A well-maintained vehicle may command a higher resale value, which can be beneficial if you decide to pay off the loan early or use the equity for other purposes. Regular inspections and timely repairs are essential to preserving the vehicle’s value, ensuring a smoother repayment journey and potentially freeing up funds for other financial goals after loan approval.

Calculating car title loan minimum payments manually is a valuable skill that empowers borrowers to make informed financial decisions. By understanding the structural components of these loans and mastering the calculation steps, individuals can effectively manage their repayment plans. This article has provided clear guidelines for manual calculations and shared tips for optimal repayment strategies, enabling folks to navigate this alternative financing option with confidence and potentially save on interest charges. Remember, when it comes to car title loan minimum payments, knowledge is power.